Condo Insurance in and around Virginia Beach

Welcome, condo unitowners of Virginia Beach

Insure your condo with State Farm today

Home Is Where Your Heart Is

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm uncomplicated. As one of the leading providers of condo unitowners insurance, you can enjoy impressive service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like books, sports equipment and appliances.

Welcome, condo unitowners of Virginia Beach

Insure your condo with State Farm today

Agent Frank Owens, At Your Service

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Frank Owens can be there whenever you have problems at home to help you submit your claim. State Farm is there for you.

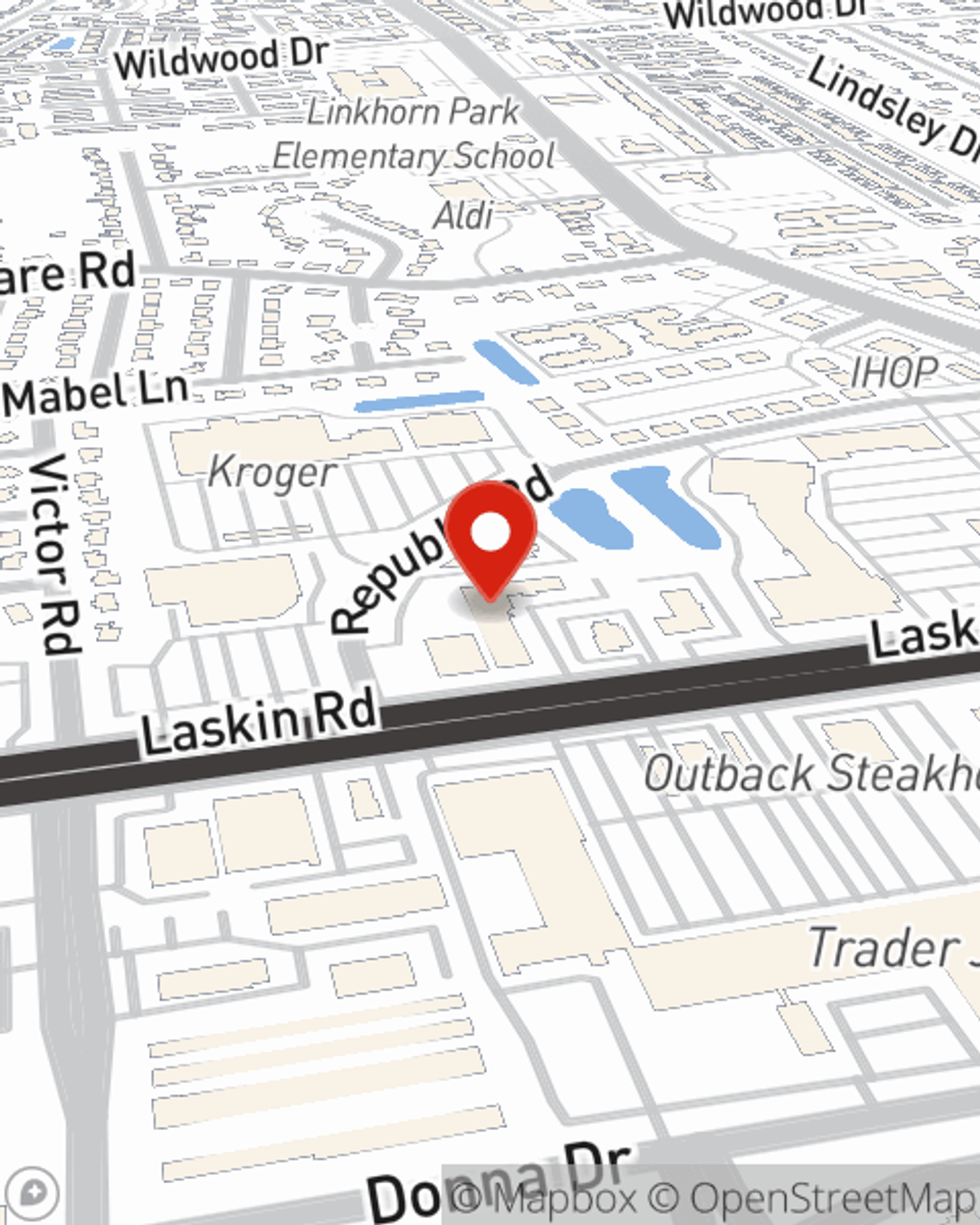

As a reliable provider of condo unitowners insurance in Virginia Beach, VA, State Farm aims to keep your belongings protected. Call State Farm agent Frank Owens today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Frank at (757) 428-3101 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Frank Owens

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.